cryptocurrency shiba inu

Cryptocurrency shiba inu

Crypto market capitalization or “crypto market cap” for short is a widely used metric that is commonly used to compare the relative size of different cryptocurrencies https://theodorhenriksen.com/7-differences-between-web-design-and-graphic-design/. On CoinCodex, market cap is the default metric by which we rank cryptocurrencies on our frontpage. We also track the total cryptocurrency market cap by adding together the market cap of all the cryptocurrencies listed on CoinCodex. The total market cap provides an estimate on whether the cryptocurrency market as a whole is growing or declining.

Cryptocurrency works through networks of nodes that are constantly communicating with each other to stay updated about the current state of the ledger. With permissionless cryptocurrencies, a node can be operated by anyone, provided they have the necessary technical knowledge, computer hardware and bandwidth.

The total crypto market volume over the last 24 hours is $148.54B, which makes a 12.36% decrease. The total volume in DeFi is currently $25.79B, 17.36% of the total crypto market 24-hour volume. The volume of all stable coins is now $138.76B, which is 93.42% of the total crypto market 24-hour volume.

However, Bitcoin is far from the only player in the game, and there are numerous altcoins that have reached multi-billion dollar valuations. The second largest cryptocurrency is Ethereum, which supports smart contracts and allows users to make highly complex decentralized applications. In fact, Ethereum has grown so large that the word “altcoin” is rarely used to describe it now.

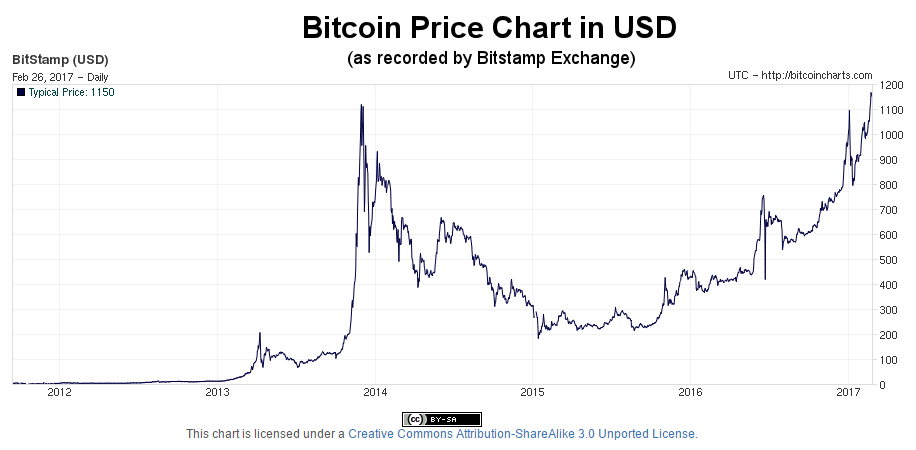

Cryptocurrency bitcoin price

The cryptocurrency market as a whole is not only based on Bitcoin’s fundamental idea of peer-to-peer transactions without the involvement of a trusted intermediary, but also remains very correlated to the price of BTC as a monetary unit.

It may be possible to buy Bitcoin instantly on centralized exchanges, because an exchange account isn’t really a wallet. Instead, it is an electronic reflection of fund balances that an exchange will display, even though the actual funds have not moved – the user is simply entitled to a small amount of the BTC held by the exchange.

Reports have claimed Bitcoin’s transactions take ‘as much electricity as an American household does in six weeks’, and that Bitcoin’s annual energy requirement amounts to more than the annual energy usage of Finland, a country of 5.5 million.

The cryptocurrency market as a whole is not only based on Bitcoin’s fundamental idea of peer-to-peer transactions without the involvement of a trusted intermediary, but also remains very correlated to the price of BTC as a monetary unit.

It may be possible to buy Bitcoin instantly on centralized exchanges, because an exchange account isn’t really a wallet. Instead, it is an electronic reflection of fund balances that an exchange will display, even though the actual funds have not moved – the user is simply entitled to a small amount of the BTC held by the exchange.

Cryptocurrency prices

CoinMarketCap does not offer financial or investment advice about which cryptocurrency, token or asset does or does not make a good investment, nor do we offer advice about the timing of purchases or sales. We are strictly a data company. Please remember that the prices, yields and values of financial assets change. This means that any capital you may invest is at risk. We recommend seeking the advice of a professional investment advisor for guidance related to your personal circumstances.

An altcoin is any cryptocurrency that is not Bitcoin. The word “altcoin” is short for “alternative coin”, and is commonly used by cryptocurrency investors and traders to refer to all coins other than Bitcoin. Thousands of altcoins have been created so far following Bitcoin’s launch in 2009.

Crypto market cap matters because it is a useful way to compare different cryptocurrencies. If Coin A has a significantly higher market cap than Coin B, this tells us that Coin A is likely adopted more widely by individuals and businesses and valued higher by the market. On the other hand, it could potentially also be an indication that Coin B is undervalued relative to Coin A.

Cryptocurrency mining is the process of adding new blocks to a blockchain and earning cryptocurrency rewards in return. Cryptocurrency miners use computer hardware to solve complex mathematical problems. These problems are very resource-intensive, resulting in heavy electricity consumption.